We have big ambitions to become the ‘best and biggest digital insurance provider’ in the UK, delivering significant profitable growth through digital leadership, embracing new technology, underpinned by our 4Cs cultural framework, aligning the interests of colleagues, customers, company, and community, which drives and supports decision making.

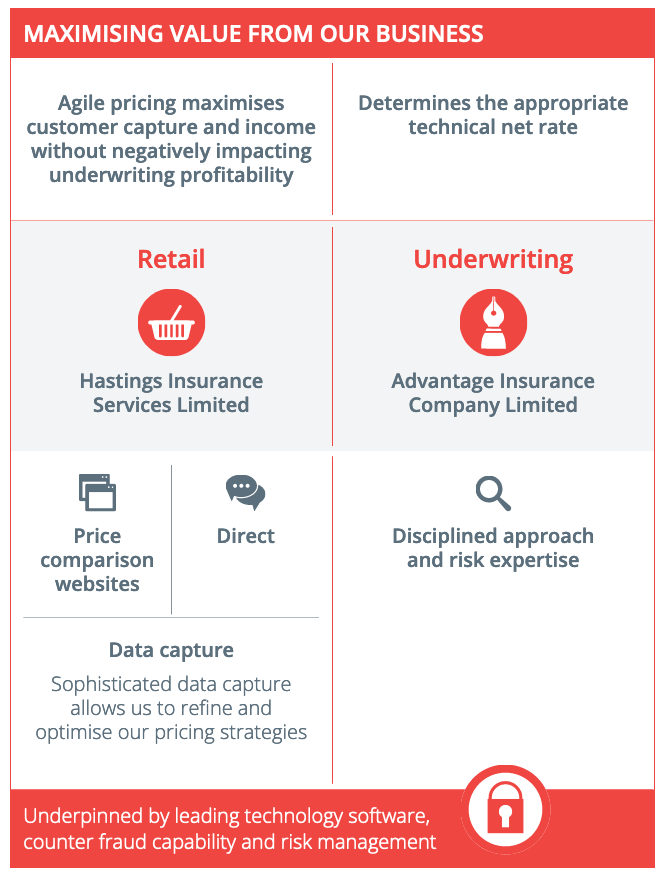

A simple and straightforward business model, digitally focused distribution and continued investment in next generation technology positions us well to drive significant profitable growth in live customer policies.

Focus on prudent underwriting, combining a dynamic approach to risk selection, extensive use of data, advanced pricing processes, and rigorous fraud detection systems to support the delivery of a stable loss ratio.

Low cost provider, supported by digital processes, with one of the highest rated mobile apps in the UK general insurance market, enabling customers to self-serve their policy, increasing engagement and keeping costs low.

Significant opportunities to increase volume of live customer policies and overall profitability by continuing to invest in our core car insurance proposition, with around an 8 per cent share of a very large market (over 32 million cars in the UK).

Continued expansion in home insurance, with a business model well placed to benefit from increasing price comparison website penetration within the large market of over 20 million homes in the UK.

Approach to corporate responsibility, framed by the 4Cs cultural framework which focusses on creating the right culture for colleagues, and giving them the right tools to do their job, so they will do more for customers, enabling the company to grow profitably and sustainably, and allowing investment in the communities served.

Ethical conduct and strong governance are integral to meeting the needs of colleagues and customers and running a successful business, and a broader focus on the environmental and social impacts of our activities underpins that philosophy. We continue to develop and enhance our corporate responsibility strategy, to include specific metrics and targets across those areas that most impact its sustainability for the long term, with full consideration of the impacts of climate change on and from its operations.